If you’re considering ketamine therapy for your mental health, you may be wondering whether your insurance will cover the cost—or if you’ll have to pay out-of-pocket. While ketamine therapy is FDA-approved for certain uses, it is still considered an “off-label” treatment for mental health conditions. This designation can limit insurance coverage.

However, some insurance plans do provide coverage for ketamine therapy. It’s essential to verify your coverage before receiving any treatment. Here’s what you should know.

Key Takeaways

- Ketamine therapy coverage by insurance may be limited due to the off-label use of ketamine for mental health conditions.

- Medicaid and Medicare offer limited coverage for esketamine (Spravato), a form of ketamine that is delivered via nasal spray.

- Private insurance plans may offer coverage for IV ketamine therapy.

- Talk to your insurance provider before you receive treatment.

Is Ketamine Therapy Covered by Insurance?

Ketamine therapy coverage may be limited due to its off-label use for mental health conditions. The term “off-label” refers to the use of a medication or treatment for a condition that is not explicitly approved by the FDA. This lack of specific approval can lead to insurance limitations, as insurers may only cover treatments that are FDA-approved for specific conditions.

Despite the extensive research showing its efficacy, insurance providers have been slow to include ketamine therapy in their coverage. This has created a challenging situation for patients seeking this treatment.

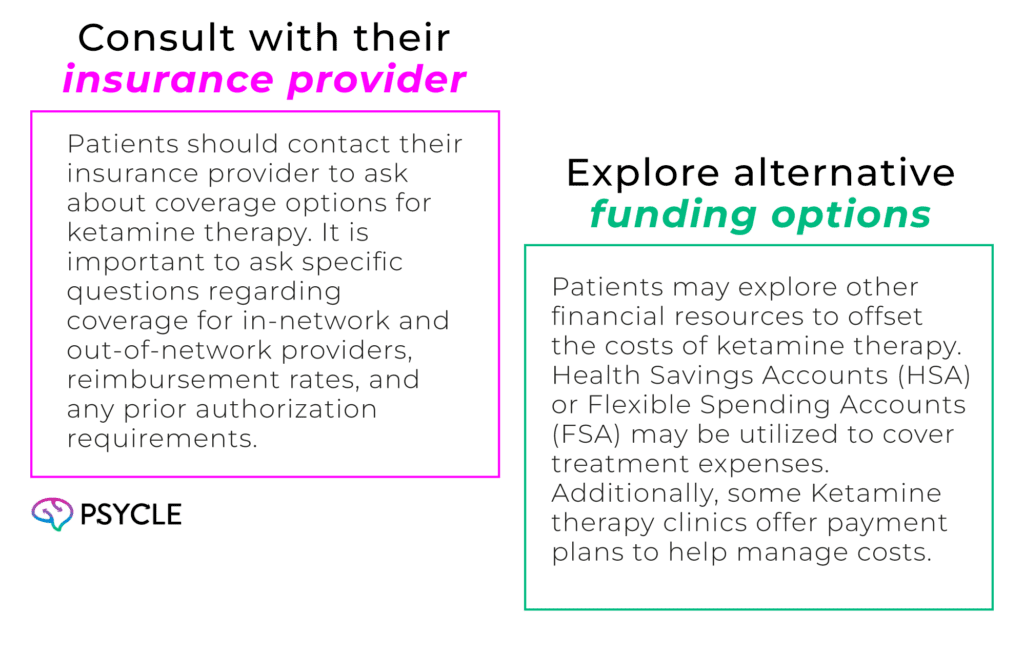

To navigate insurance limitations for ketamine therapy, patients should consider the following:

Medicaid and Medicare Coverage for Ketamine Therapy

Medicaid and Medicare typically do not cover IV ketamine infusions for depression. However, both programs cover esketamine (Spravato), a form of ketamine that is FDA-approved for individuals with treatment-resistant depression. Spravato, which is a nasal spray, is only available via prescription, which means you’ll need to talk to a doctor and meet eligibility criteria beforehand.

It’s worth noting that coverage for ketamine therapy under Medicaid and Medicare can vary based on different factors, such as specific state policies, individual eligibility criteria, and the treatment provider. Patients should reach out to their insurance provider to learn more about the coverage options available to them.

Private Insurance Coverage for Ketamine Therapy

Private insurance plans may offer coverage for IV ketamine therapy, providing patients with opportunities to access this innovative treatment. However, it is essential for patients to verify their coverage with their insurance provider, as coverage may vary depending on the specific plan and policy.

Several private insurance companies have been known to cover ketamine therapy, including Blue Cross Blue Shield and United Healthcare. However, it is important to note that not all plans may offer the same level of coverage—some plans may only offer partial reimbursement, and others may only cover treatments if the provider submits an itemized invoice of services (also known as a superbill).

Patients should thoroughly review their policy documents and consult with their insurance representative to fully understand the extent of coverage for ketamine therapy.

Insurance Coverage for Esketamine (Spravato)

Spravato is FDA-approved, which means a greater number of insurance providers will cover esketamine as a treatment option for individuals with treatment-resistant depression. If ketamine infusions aren’t an option with your insurance, it may be worth talking to your doctor about whether esketamine therapy makes sense for you (and be sure to check your insurance coverage ahead of time).

Summary

Coverage for ketamine therapy varies widely depending on insurance providers, plans, and policies. While some insurance companies may offer coverage for ketamine therapy, it is not guaranteed, and patients should verify their individual coverage.

Navigating insurance for ketamine therapy can be complex, but there are options available for financial assistance. Patients should contact their insurance provider and consult with the ketamine therapy clinic to understand their coverage and explore ways to make ketamine therapy more accessible.

FAQs

What are the Insurance Limitations for Ketamine Therapy?

Ketamine therapy coverage may be limited due to its off-label use for mental health conditions. Insurance providers often have not extended their coverage to include ketamine therapies.

Is There Medicaid and Medicare Coverage for Ketamine Therapy?

Medicaid and Medicare offer limited coverage. While they typically do not cover ketamine infusions for mental health, both Medicaid and Medicare may cover esketamine (Spravato) for treatment-resistant depression.

How Does Insurance Coverage for Spravato (Esketamine) Differ for Generic Ketamine Therapy?

A greater number of insurers cover esketamine, sold under the brand name Spravato, because it is FDA-approved for treatment-resistant depression. In comparison, ketamine therapy is off-label and isn’t officially approved for mental health therapy.

How Much Does Insurance Coverage for Ketamine Therapy Vary?

Insurance coverage for ketamine therapy varies widely, with some insurance plans offering limited or no coverage and others providing more comprehensive coverage. Factors such as the insurance provider, plan, and specific policies can affect coverage. It’s important for patients to research and verify their individual insurance coverage to understand what expenses they may be responsible for.

Are There Financial Assistance Options for Ketamine Therapy?

Patients seeking financial assistance for ketamine therapy have various options to help offset the costs. Some clinics offer payment plans and can work with patients to manage or reduce expenses. Additionally, patients can inquire about reimbursement for out-of-network care using a superbill, which provides an itemized breakdown of charges. Patients may also explore other financial resources, such as HSA/FSA accounts.